Earlier this week, Slack announced that it has filed the paperwork to go public at some point later this year. The big question is, will the company exit into the public markets as expected, or will one of the technology giants swoop in at the last minute with buckets of cash and take them off the market?

Slack, which raised over $1 billion on an other worldly $7 billion valuation, is an interesting property. It has managed to grow and be successful while competing with some of the world’s largest tech companies — Microsoft, Cisco, Facebook, Google and Salesforce. Not coincidentally these deep-pocketed companies could be the ones that come knock, knock, knocking at Slack’s door.

Slack has managed to hold its own against these giants by doing something in this space that hadn’t been done effectively before. It made it easy to plug in other services, effectively making Slack a work hub where you could spend your day because your work could get pushed to you there from other enterprise apps.

As I’ve discussed before, this centralized hub has been a dream of communications tools for most of the 21st century. It began with enterprise IM tools in the early 2000s, progressed to Enterprise 2.0 tools in the 2007 timeframe. That period culminated in 2012 when Microsoft bought Yammer for $1.2 billion, the only billion dollar exit for that generation of tools.

I remember hearing complaints about Enterprise 2.0 tools. While they had utility, in many ways they were just one more thing employees had to check for information beyond email. The talk was these tools would replace email, but a decade later email’s still standing and that generation of tools has been absorbed.

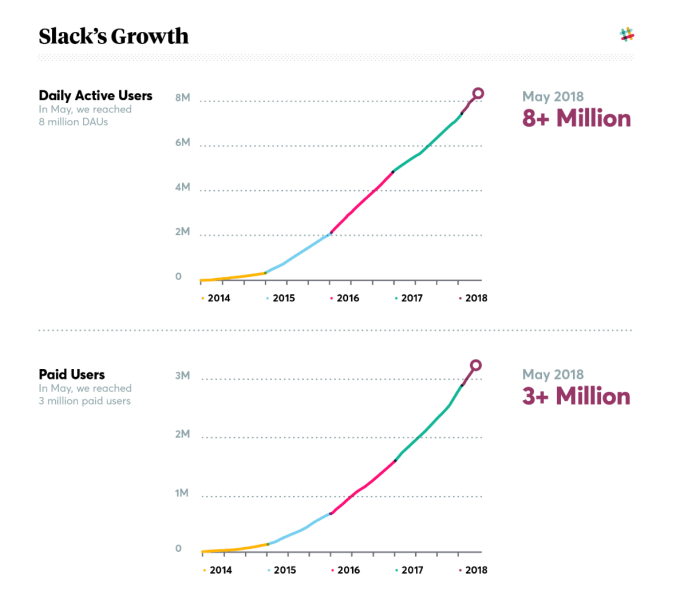

In 2013, Slack came along, perhaps sensing that Enterprise 2.0 never really got mobile and the cloud and it recreated the notion in a more modern guise. By taking all of that a step further and making the tool a kind of workplace hub, it has been tremendously successful growing to 8 million daily users in roughly 4 years, around 3 million of which were the paying variety, at last count.

Slack’s growth numbers as of May 2018

All of this leads us back to the exit question. While the company has obviously filed for IPO paperwork, it might not be the way it ultimately exits. Just the other day CNBC’s Jay Yarrow posited this questions on Twitter:

Not sure where he pulled that number from, but if you figure 3x valuation, that could be the value for a company of this ilk. There would be symmetry in Microsoft buying Slack six years after it plucked Yammer off the market, and it would remove a major competitive piece from the board, while allowing Microsoft access to Slack’s growing customer base.

Nobody can see into the future, and maybe Slack does IPO and takes its turn as a public company, but it surely wouldn’t be a surprise if someone came along with an offer it couldn’t refuse, whatever that figure might be.

source https://techcrunch.com/2019/02/07/someone-could-scoop-up-slack-before-it-ipos/

No comments:

Post a Comment